Explore why family office CFOs choose Sage Intacct, how it solves industry-specific challenges and how to build your technology ecosystem.

As a family office leader, you face an ever-growing list of demands. But too often, the technology meant to support you falls short. Many family offices still rely on outdated, disconnected systems and manual processes that drain resources and slow decision-making. Lacking the right technology leads to bottlenecks, limited data insights and spreadsheet overload, creating a cloudy financial picture.

The tech stack you build today will shape your family office’s future. The right solutions can simplify operations, save time, reduce risk and deliver the real-time insights your stakeholders/family members expect. By upgrading your family office infrastructure, you’re helping your organization work more efficiently, scale with ease and meet the complex needs of the wealth owners you serve while maintaining the high level of service they count on.

This playbook explores how a modern, connected technology ecosystem, anchored by a core enterprise resource planning (ERP) solution like Sage Intacct for Family Office, can help you reinvent your operations, solve your toughest challenges and drive long-term success.

Automate payroll and financial processes

Track and manage cash flow

Customize reporting and dashboards

Reduce risk

Support growth

Connect entire tech stack

When it comes to managing the financial complexities of a family office, you need a solution that goes beyond basic accounting software. Here’s why family office leaders trust Sage Intacct to power their operations:

You and your team must overcome daily obstacles to deliver the high-value services your wealth owners expect. Here’s how a connected tech ecosystem, driven by Sage Intacct for Family Office, can help eliminate them:

It might be time for a tune-up. Get a Health Check to make sure your setup is current and that you’re making full use of Sage Intacct’s automation, reporting and integration features to drive operational excellence.

Your family office relies on multiple systems to manage finances, investments and client relationships. If these systems don’t communicate, your team is likely stuck contending with manual workarounds — and losing key information in the process.

A connected tech ecosystem eliminates these gaps, providing seamless integration across platforms and real-time access to critical financial and operational data. By centralizing your financials with a dynamic ERP like Sage Intacct, your entire tech stack becomes more efficient and effective.

Sage Intacct for Family Office unifies critical functions like portfolio tracking and financial reporting, integrating them into simplified workflows. It can also house financial and operational data for all family members and entities. This builds a single source of truth, ensures consistency across platforms and gives you clear oversight of your wealth owners’ full financial picture.

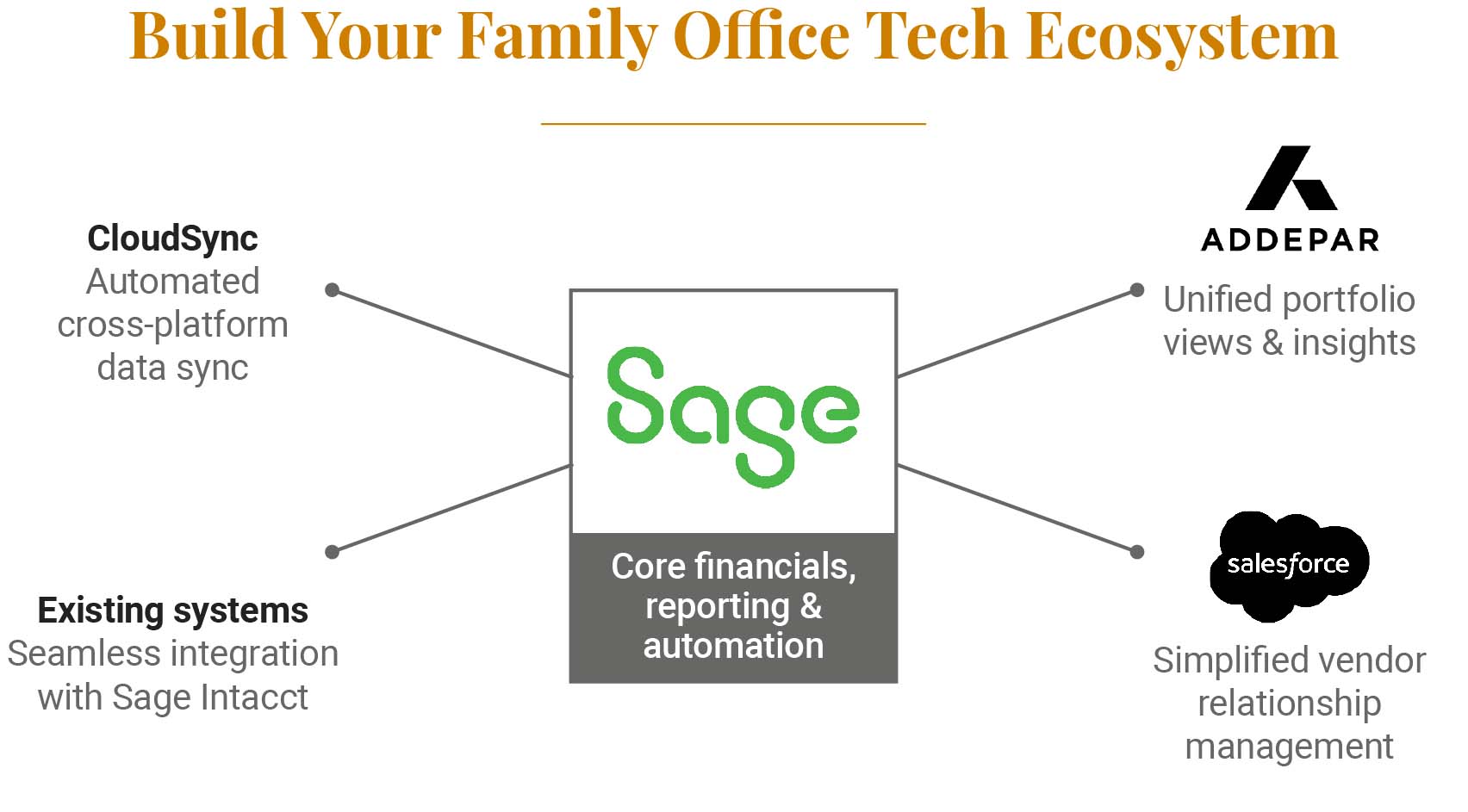

Building your family office tech ecosystem around a central ERP like Sage Intacct creates a powerhouse foundation for your operations. Adding specialized systems for investments, client management and compliance gives you a cohesive, high-performance environment for easy communication and smooth operations.

Here’s an example of how a well-integrated tech stack comes together:

Sage Intacct as your cornerstone: This dynamic ERP acts as the heart of your operations, managing the centralized financial management, reporting and automation that drives efficiency across all areas of your family office.

Addepar: Integrate Sage Intacct with a cloud-based investment reporting platform like Addepar to consolidate financial and investment data into one view. This helps you get meaningful insights to track and manage investments more effectively.

Salesforce: Connect Sage Intacct and Salesforce to manage your entire vendor network — from lawyers and real estate agents to money managers and investment bankers — in one place. Integrating this kind of relationship management platform helps you track interactions and enhance communication, ensuring your family office stays organized and connected with key partners while keeping financial data safe, accurate and updated.

CloudSync: An Armanino proprietary cloud integration platform, CloudSync can synchronize data between your family office systems, ensuring real-time consistency and keeping all platforms up to date without manual intervention.

Other existing systems: If your family office wants to continue using some other existing systems (AP bill pay, credit card management, banks, money managers, etc.), no need to worry. Sage Intacct integrates easily with what you already have, bridging gaps without impacting service delivery.

Building a tech stack that supports your family office’s goals is essential to sustainable success. Here are some key best practices to get started:

Choosing an implementation firm with family office expertise is just as important as selecting the right software. As a leading family office consultant and premier Sage Intacct partner for more than 10 years, we’ve helped single- and multi-family offices of all sizes with rapid implementation and ongoing support. Learn more about what powers ERP project success and explore how our award-winning Sage Intacct for Family Office consultants can help you get the most value from your ERP transformation.

Download White Paper (PDF)Gain back time and deliver more value. Contact our Sage Intacct experts today to learn how to start modernizing your family office operations.