As organizations advance toward digital transformation, they often reach an inflection point where they must either shed legacy systems or risk being left behind. After completing numerous mergers and more than doubling in size in four years, Armanino arrived at that juncture when its outdated tech stack started to hinder its expansion.

The firm was at a point where it was outgrowing its time entry and billing systems, causing challenges across the Office of the CFO from the GL team to FP&A, impacting the entire firm’s ability to continue its profitable, scalable growth. On the human resources (HR) side, integrations with benefit carriers were disjointed, and Armanino’s workforce also needed real-time, remote access to their personal data. Business leaders identified Workday’s platform as the solution to support the company’s rapid growth and deliver:

If you’re considering implementing Workday, this white paper provides useful insight into our modernization journey and the lessons we learned throughout the process. You’ll find out how the platform is transforming the firm’s finance, payroll and HR functions to accelerate our growth, as well as tips to set you up for success in your own implementation.

As Armanino grew, so did its technology infrastructure. Using 15 different platforms, the firm built a complex ecosystem to meet its increased needs. But over time, these mission-critical systems became siloed and rigid.

Expanding to new markets created growing pains. As the company acquired more firms, its older solutions struggled to fold in data from these other sources — making it challenging for finance to take a deep dive into the company’s analytics.

At the same time, HR still had to audit siloed data to ensure its integrity. While employees became increasingly mobile and reporting needs were more sophisticated, the back office needed a real-time data solution with a streamlined approach.

In response to these roadblocks, finance and HR leaders began to ask: Can we navigate digital change as we continue to work toward our goals? How do we adopt a solution that supports our company’s continued expansion? What are the agile tools that we need to future-proof our workflows?

When they couldn’t answer these questions, it became clear that it was time for a tech stack upgrade. After an extensive nine-month search, Armanino leadership found their solution in a single platform that could help run every aspect of the business: Workday.

Due to the complexity of these projects, it’s unusual for companies to adopt all of this robust system’s products at once. However, Armanino’s leadership saw the value of investing in a full-suite implementation of Workday’s Financial Management and Human Capital modules. Prompted by market changes and a growing need for data, the firm chose the cloud-based system as the comprehensive, long-term solution that would set the foundation for sustainable growth.

“What I’m really excited for is that it starts with our people,” says Armanino Chief Financial Officer John Kogan. “With Workday, you can plan for someone’s wages, their benefits and their career.” While Armanino had been a Workday Adaptive Planning user for a number of years, connecting Workday to firm-wide frameworks “supports learning and development in a way that naturally flows into the financials while keeping it all in a single system,” Kogan explains.

With Workday, you can plan for someone’s wages, their benefits and their career.

- John Kogan, Armanino Chief Financial Officer

Leadership determined that a full-suite implementation of Workday was the best way to propel Armanino beyond its aggressive growth goals. This complete adoption meant that both finance and HR would migrate to a unified platform within 10 months. But what leaders didn’t fully grasp was just how transformative this effort would be.

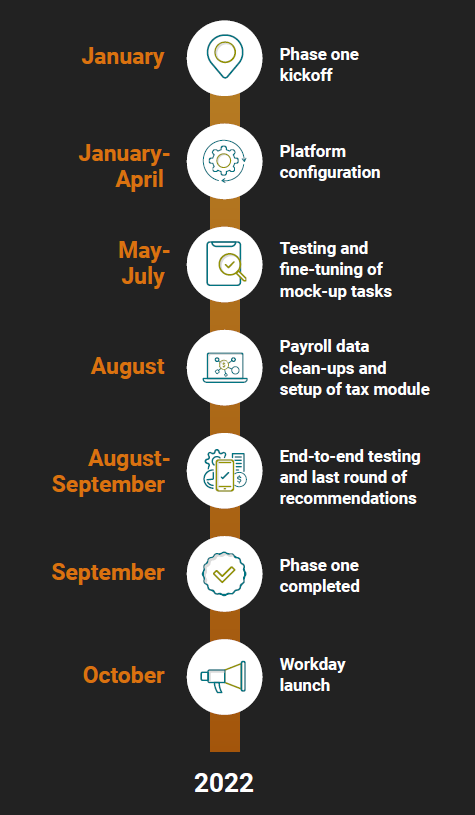

With help from Armanino’s sales operations, accounts payable and payroll teams, Kogan and his assistant controller kickstarted the Workday design and configuration phase in late January 2022. At that point, “we knew this was going to be a two-phase approach to an internal implementation,” says Kogan. “And, we knew that we wanted to launch at the beginning of Q4 because a lot of our federal reports and payroll taxes are done quarterly.”

During the 10-week configuration phase, Armanino worked with Workday consultants to design a framework for what the system would look like. To maximize the natural efficiencies that Workday offers, Armanino’s approach was to use the platform as intended without any customizations. This would allow Armanino to make the most of a unified system for firm-wide collaboration and sustained efficiency, while also avoiding time-consuming customization tests after software updates.

For Armanino’s Initiatives & Operations Director, Angie Intriago, the configuration phase was an opportunity to really think through the company’s processes. “Setting up Workday forces you to think about scalability. That’s good because it allowed us to take a look at what we’d been doing to analyze how our new approach would fit in with our long-term plans,” says Intriago.

As part of this initial framework, the Workday specialists created simulated tasks for the Armanino finance team to explore. Known as “tenants,” these mock-ups gave Armanino the opportunity to walk through some basic Workday functions and provide feedback.

Over a period of nine weeks, Workday consultants took Armanino’s input to tweak and adjust the tenants. From May through early July, the team of more than 40 Workday experts went through three tenants as they collaborated to meet Armanino’s needs and provide exceptional project management. “Their client service to us was phenomenal,” Kogan says.

In the meantime, the Armanino staff worked hard and long hours to complete the Workday configuration and fine-tune the tenants. But before testing began, Kogan realized that he needed additional resources to stay on track with the expected launch date. The payroll component was falling behind, the project was approaching crunch time and upholding the finance team’s work-life balance was a priority.

To keep moving forward, Armanino hired Workday payroll expert Vanessa Windsor to support the payroll team’s efforts. “It can be hard to make the flip from a traditional payroll engine to Workday’s live data ingestion,” says Windsor. But with this dynamic system’s access to real-time information, “you know about changes as they happen, so you have more time to address any issues and avoid being in the pressure cooker 72 hours before it’s time to run payroll.”

With Windsor’s help, payroll was able to clean up the data and set up the tax module before the company’s annual filing deadline. In the meantime, life went on as usual. “People still got promoted. People still had benefit changes. The business didn’t stop,” Intriago says.

Thanks to the extra help, Armanino’s full-time staff could “free up mind space,” Kogan explains. This allowed the team to focus on the new software and move on to end-to-end testing of transactions in Workday.

Prior to Workday, transactions such as vendor purchases lacked sufficient control. Employees could request a product or service, and the approval of the invoice occurred after the fact. At that point, the product or service had generally been received so the firm was liable for the invoice. The new procurement process moves the approval to the beginning of the process and makes the finance department “much smarter about the money that we spend, where we spend it, and when we spend it,” says Kogan.

During end-to-end testing, the Armanino finance and procurement staff were able to take a transaction from start to finish. By evaluating Workday’s functionality under everyday scenarios, these teams experienced how data availability could streamline communications while keeping operations one step ahead.

After end-to-end testing was completed, the Workday team produced a final round of tenants. With the finish line in sight, the teams tested during the months of August and September. Armanino provided a last round of recommendations and Workday consultants continued to polish the system until the platform was locked and loaded in early September.

By October 1, Armanino achieved its launch date and started transacting in Workday. It was the successful conclusion of a nine-month deployment that will advance the firm into its next stage of success.

Here’s how Armanino was able to launch Workday’s Financial Management and Human Capital modules in only 10 months.

Armanino’s finance, HR and payroll teams are already seeing both tangible results and softer benefits. While the project is ongoing, early gains from phase one of the Workday implementation include:

By allowing Armanino to sunset 15 systems, the transition to Workday will save the company money, enhance communication between HR and finance, and create a better experience for all employees. “This is an investment in our future and in having a modern platform that is continuously supported because it’s in the cloud,” says Kogan.

With Workday up and running, Armanino leadership continues to take steps toward the company’s goals. During phase two of this implementation, Armanino expects to replace its current PPM billing system with the Workday Professional Services Automation (PSA) tool.

Workday will help Armanino automate more workflows, such as the company’s procurement process and journal entries, while also allowing management to optimize data for better decision-making. With six-, nine- and 12-month lookbacks already planned, leadership expects to continue supporting the company’s rapid growth, as the Workday system adapts to Armanino’s changing needs.

A full-suite Workday implementation is not for the faint of heart. These are some of the approaches that helped Armanino succeed with the deployment:

Having completed phase one, these are the three main lessons that the finance, payroll and HR teams learned:

Although topics such as employee benefits and salaries are confidential, it’s important to keep communications transparent among key players to streamline the configuration process. Having the right people in the right room helped the HR team avoid many challenges as they designed the platform to meet the firm’s needs.

While conference calls may be challenging to fit into everyone’s schedule, they are a necessary part of the process because the calls facilitate problem-solving and ultimately help save time by gathering all key stakeholders to share important updates.

By backfilling staff early in the implementation process, Armanino was able to ramp up the hours necessary to launch on time and allow permanent staff to test the system in a risk-free environment. It also was beneficial to keep the additional support after going live, so they could help the payroll team wind down the old processes and ensure a successful transition.

Updating your core business technology can be a challenge. But you don’t have to go it alone. As a Workday Services partner, we have extensive industry and finance expertise to help you build and execute a strategy for success. Contact our Workday experts to start optimizing your tech stack today.