Payment Card Industry (PCI) Compliance Services

Payment Card Industry Data Security Standard (PCI-DSS) compliance encompasses a set of mandatory cybersecurity standards and controls designed to safeguard customer card data. If your organization captures, stores or processes credit or debit cards, PCI compliance applies to you.

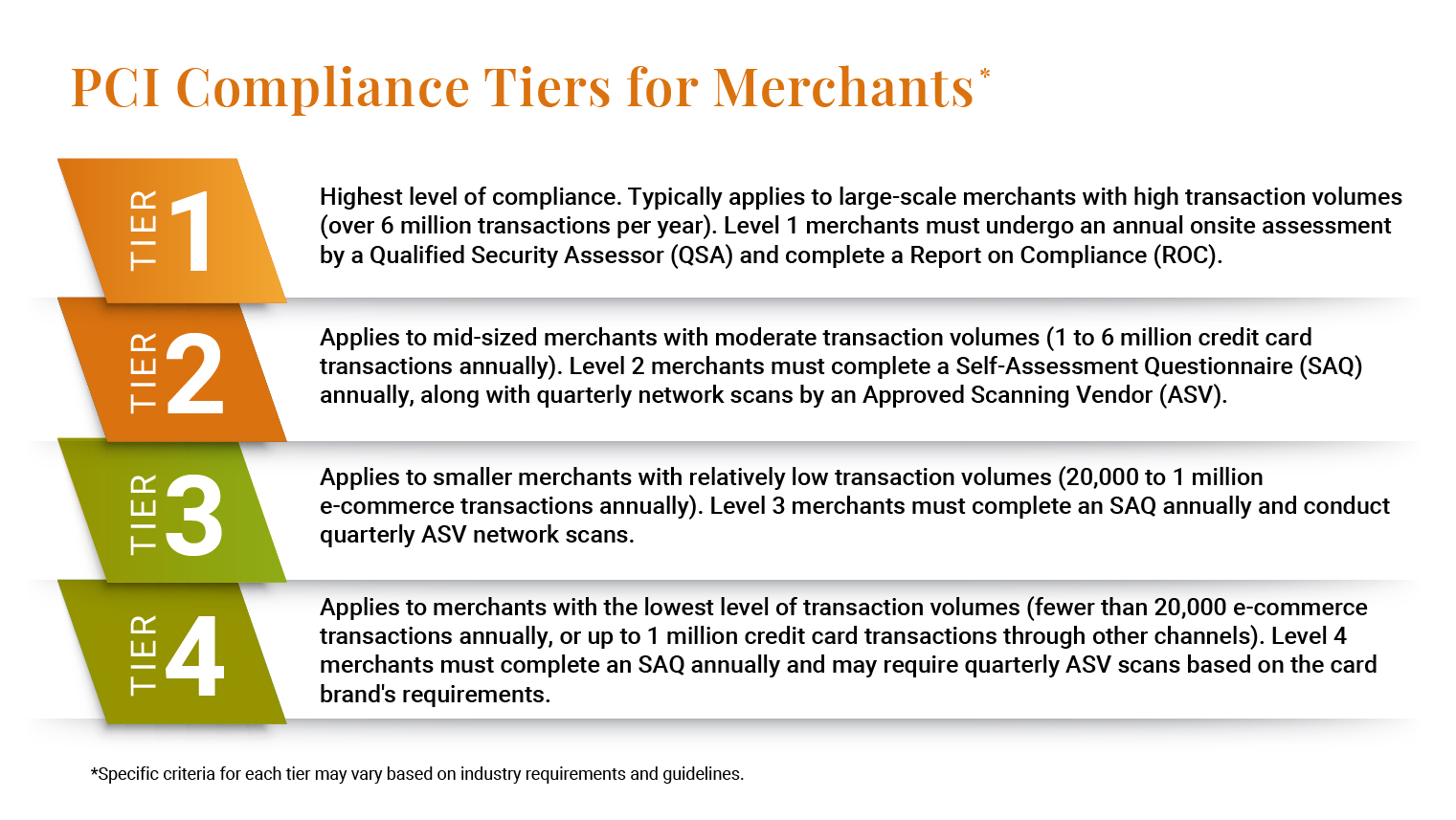

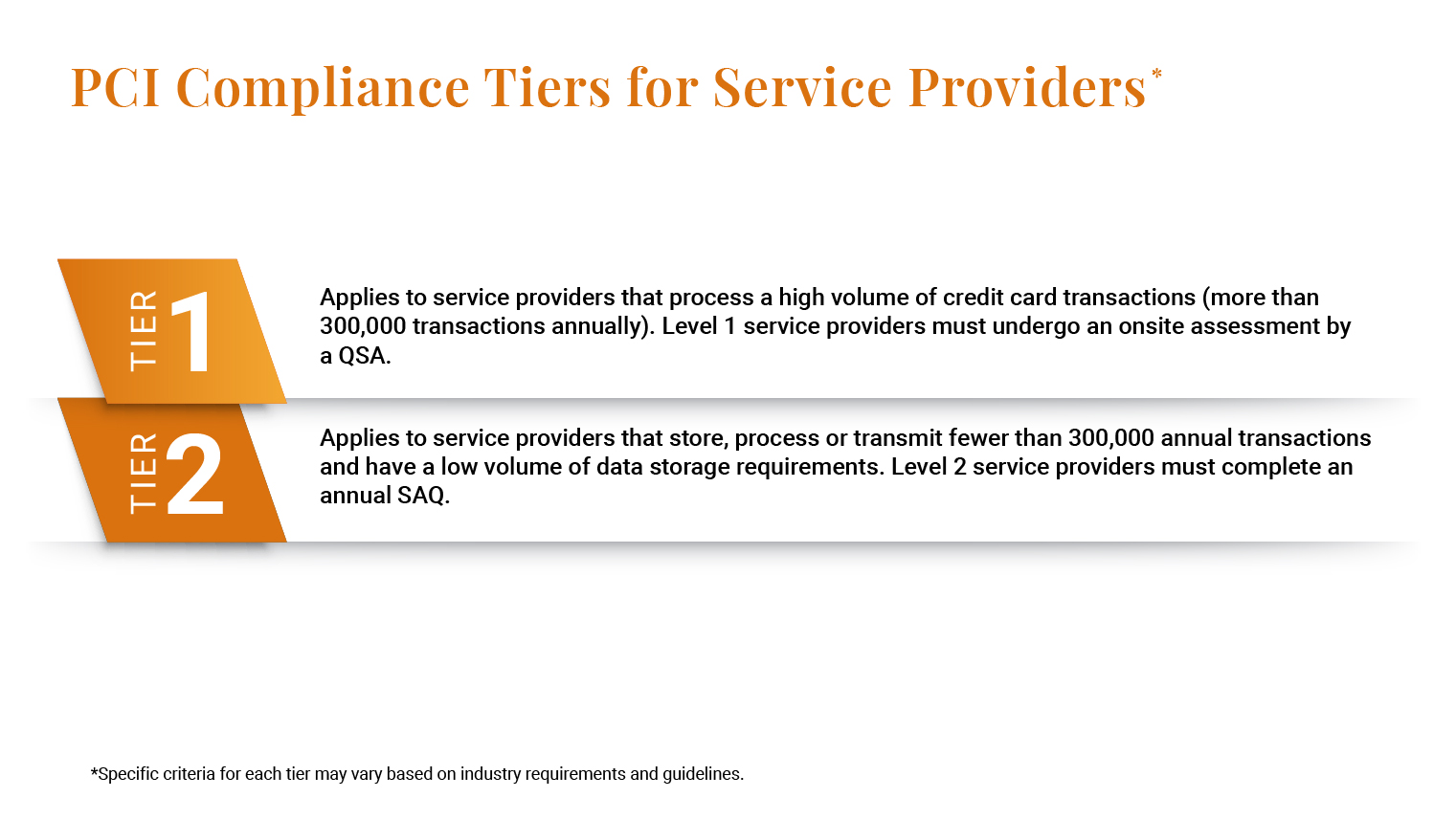

PCI compliance levels vary depending on whether you operate as a merchant or a service provider.

Merchants typically engage in business-to-consumer (B2C) activities, such as e-commerce platforms or brick-and-mortar stores, while service providers offer various services or infrastructures that support the payment cycle, but may not directly handle credit cards or facilitate sales. An entity can also operate as both a merchant and a service provider simultaneously.

To become PCI compliant, your organization must develop a strong foundation in cybersecurity and data privacy, follow a set of specific obligations and possess a thorough understanding of the following areas:

Checklist

Are You Correctly Following PCI Compliance Requirements?Stay on track with key PCI requirements by following this PCI compliance checklist:

We are committed to creating value for your organization by tailoring our services to your specific needs. The type of engagement we perform and the corresponding fee structure vary based on your PCI compliance level and the maturity of your organization.

Maintaining PCI compliance is crucial to avoid potential fines and penalties. Non-compliance can result in significant financial consequences, which vary depending on whether a breach occurred, breach severity and other factors.

Our Methodology

How We Help You Navigate the PCI Compliance ProcessWe take a proven, step-by-step approach to help you achieve and maintain PCI compliance and set your organization up for sustained success:

We conduct a detailed risk and scoping assessment to determine the necessary boundaries and the scope of people, process and technologies required to support card payments. We analyze potential solutions, align them with your business goals and help develop clear objectives and direction for stakeholders.

Together, we define a testing period and determine when any procedures would be performed. This phase also includes questionnaires and document owner assignments.

We provide a draft report for review and discussion, outlining potential issues, recommendations for improvement and best practices.

After certification, we identify continuous improvement opportunities and offer consistent communication in support of the annual recertification process. We also proactively monitor changes to requirements and trends and collaborate with you to adapt to any ongoing changes and understand their impact on your environment.

Customizable Solutions

PCI Compliance Consulting ServicesIf you're starting your PCI journey, our Qualified Security Assessors will measure your current state and develop practical recommendations to help you become PCI compliant.

Validate your security measures by completing a thorough PCI compliance test and PCI compliance audits for certification.

Identify and address security weaknesses and blind spots within your organization.

Our Qualified Security Assessors will perform a formal PCI assessment against the current standards and issue an Attestation of Compliance, Report on Compliance, and Self-Assessment Questionnaire.

Ensure your business and customer data are not vulnerable to cyberattacks or non-compliance fines. Connect with our PCI compliance consultants today for a free assessment.