Find a Resource

By Service Area

Article

Once you have an ERP in place, phase two is your chance to maximize the software and unlock the next level of growth.

December 06, 2022

Updated April 21, 2023

Article

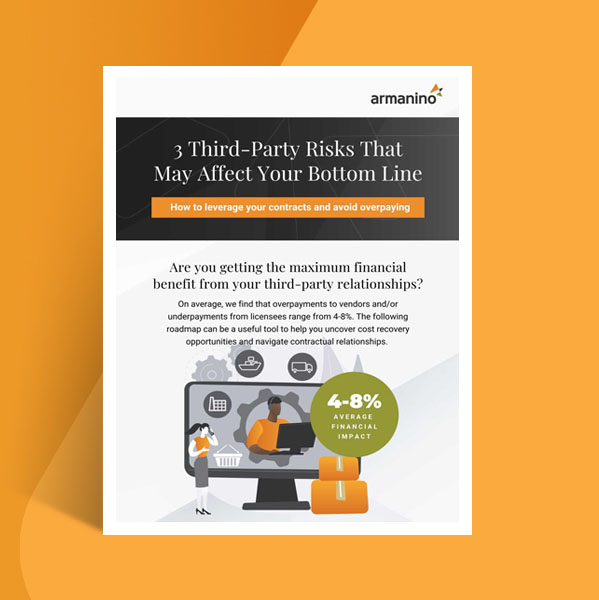

Are you setting your organization up for unnecessary risk and missing bottom line growth opportunities?

November 17, 2022

Article

These metrics can provide unique insights into your organization and its customer purchasing journey.

November 17, 2022

Article

The new laws, including SB 1162, require pay ranges on job postings and expanded pay data reporting.

November 15, 2022

Article

Here’s how the election may affect TCJA, the R&D credit, the Inflation Reduction Act, retirement savings and more.

November 15, 2022

Article

Learn how you can improve your SOX IT controls to keep up with ever-changing technology demands and minimize risk.

November 08, 2022

Article

Learn how AI can be leveraged to automate key processes, alleviate operational burdens and achieve your specific goals.

November 04, 2022

Article

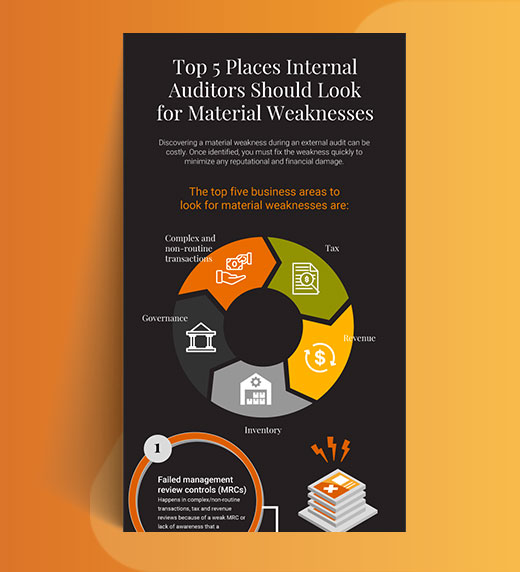

Our infographic illustrates the top five places internal auditors should look for material weaknesses.

November 01, 2022

Article

Ensure your stakeholders understand SaaS cash flow nuances and improve your cash flow for the long haul.

October 19, 2022

Article

Stay ahead of the curve, gain operational control and minimize employee training.

October 18, 2022

Article

Discover how contract management can benefit your bottom line and help you develop efficient vendor relationships.

October 10, 2022

Article

If your company struggles with its SOX audit because of personnel and data challenges, consider if automation can help.

October 07, 2022

Article

When moving your company to a new location, there are tax-related factors that can help you identify the ideal place.

October 07, 2022

Article

An unforgiving regulatory environment gives cannabis businesses limited options when facing financial insolvency.

October 05, 2022

Article

Leverage technology to keep your organization cutting-edge and competitive.

October 03, 2022

Article

Get a clearer picture of your finances by learning how to properly calculate and analyze your SaaS metrics.

September 28, 2022

Article

Use technology to spur innovation, reduce overhead and optimize resources throughout your healthcare revenue cycle.

September 27, 2022

Article

Here’s how the real estate market has shifted and where we see the biggest investment opportunities.

September 22, 2022

Article

From seed to sale, your organization can leverage its existing data to become more efficient and strategic.

September 20, 2022

Article

Learn Environment Social Governance frameworks for assessment, scoring, reporting, or disclosure.

September 13, 2022

Article

Learn what Environmental Social Governance (ESG) is and why it matters.

September 13, 2022