Background

As of January 1, 2018, the Tax Cuts and Jobs Act (Public Law 115-97, TCJA) eliminated the prior asset categories of Qualified Leasehold Improvement Property, Qualified Restaurant Property and Qualified Retail Improvement Property, and consolidated them into Qualified Improvement Property (QIP). While the conference agreement to TCJA clearly indicated congress intended QIP to be treated as a 15-year MACRS and 20-year ADS property, drafting errors in the final text of TCJA failed to property “link” definitional sections within the code. This resulted in QIP receiving no special treatment, with the default falling back to 39-year MACRS and 40-year ADS non-residential real property.

On March 27, 2020, President Trump signed H.R. 748, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) into law. Section 2307 of the CARES Act included technical corrections to treat QIP as a 15-year MACRS asset and 20-year ADS asset, as originally intended by TCJA. Importantly, the bill treats this as a technical correction, and the amendment under CARES §2307 take effect as if originally included in the text of the TCJA. As a result, QIP is treated as if it were a 15-year MACRS/20-year ADS asset from the effective date of the TCJA, or January 1, 2018.

What is Qualified Improvement Property?

QIP is defined as any improvement made by the taxpayer to an interior portion of a building that is non-residential real property if such an improvement is placed in service after the date such building was first placed in service (specifically excludes the enlargement of a building, any elevator or escalator, or the internal structural framework). It is critical to emphasize here that QIP exists only with respect to non-residential real property. If the property in question is residential, the addition is not QIP and the discussion in this alert regarding its classification is irrelevant. If the property is residential, the asset is a 27.5-year MACRS asset and a 30-year ADS asset (40-year if placed in service before January 1, 2018).

Interaction of QIP with an Electing Real Property Trade or Business Election under §163(j)

Under §163(j)(7)(A), an eligible real property trade or business can elect out of the business interest expense limitations of §163(j) by making an Electing Real Property Trade or Business Election (ERPTB). The “pay-for” for being allowed to escape the §163(j) interest expense limitation is the taxpayer must use ADS depreciation, under §168(g), for any non-residential real property, residential rental property and Qualified Improvement Property held by an electing real property trade or business.

Impact of CARES Act on QIP Depreciation

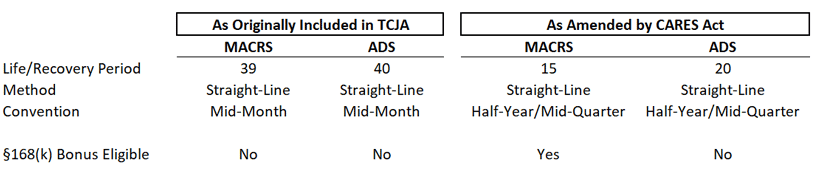

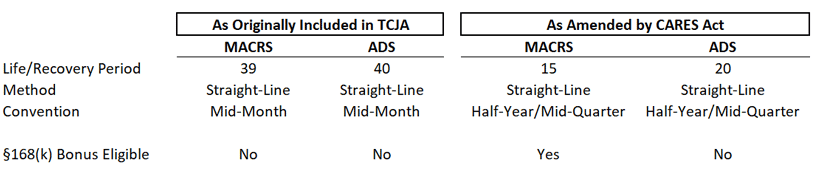

Below is a chart summarizing the CARES Act’s impact on QIP deprecation, which retroactively treats QIP as a 15-Year MACRS/20-Year ADS asset rather than a non-residential real property (under §168(c)).

Impact of CARES Act QIP Depreciation Changes on Our Clients

The impact to our clients will depend on (i) whether the assets are residential or non-residential and (ii) if the property was previously the subject of an ERPTB election.

- Residential Real Property - As noted above, QIP refers only to non-residential real property. This change has zero impact on property placed in service during 2018 – 2020 related to residential real property.

- No ERPTB Election – 27.5-year MACRS Asset (straight line, mid-month, no bonus)

- ERPTB Election – 30-year ADS Asset (straight line, mid-month, no bonus) if placed in service January 1, 2018, or later. If placed in service prior to January 1, 2018, the ADS life is 40 years.

As such, the impact of an ERPTB election upon the depreciation of the property is unchanged and generally continues to be minimal. A key takeaway here is that the if the client originally felt the change from MACRS to ADS to avoid §163(j) limitations was correct, that analysis is unchanged by this legislative amendment.

- Non-Residential Real Property – This is where the impact of the change will be felt and directly impacts the cost-benefit analysis of the ERPTB election, as the cost has now increased.

- No ERPTB Election – what was a 39-year SL/MM/No Bonus now becomes a 15-year, accelerated straight-line, and is potentially subject to 100% bonus depreciation under §168(k). Opportunities will exist for these clients to adjust depreciation schedules and accelerate deductions as compared to what was allowed under TCJA.

- ERPTB Election – Under §163(j)(7)(B), an ERPTB election is irrevocable. As it stands currently, any taxpayer with an ERPTB in place would be required to continue to use ADS depreciation for its QIP property, which means 20-year ADS rather than 40-year ADS. While this is still an acceleration of deprecation as compared to what was allowed under TCJA, the taxpayer is still losing out on what could have otherwise been fully deducted as bonus depreciation.

- How will depreciation changes be reported?

- Very little detail has been provided as to how these depreciation changes and related elections (e.g. elections out of bonus deprecation under §168(k)(7)) will be made/reported to the IRS. Possibilities include:

- Amending prior tax returns (2018 and possibly 2019) to claim larger depreciation deductions.

- Filing Form 3115 for automatic method changes with current or future tax returns (2019 or subsequent tax years).

- Potential streamlined IRS administrative guidance for the change. Examples could include:

- Need to consider administrative burden of various options and impact to 2019 reporting

- If intent is to amend 2018 returns to claim bonus depreciation on QIP, you should not be claiming depreciation expense in 2019.

- Amending returns may be impractical for large tiered partnership structures.

Immediate Action Items

- Review 2018 – 2019 non-residential real property additions to determine if they would qualify as QIP.

- If QIP was placed in service in 2018, possible options include:

- Amend 2018 return to take bonus and/or shorten life from 39-year MACRS to 15-year MACRS (40-year ADS to 20-year ADS).

- Leave 2018 as is and make method change (3115) in 2019 (or 2020).

- If QIP was placed in service in 2019, possible options include:

- Leave as is and make accounting method change in 2020.

- Update 2019 calculations and re-distribute K-1s.

- If plan is to amend 2018 and claim bonus, you may need to remove depreciation deduction for QIP from 2019 calculations.

- Analysis above applies to clients who used ADS (REITs, taxpayers making an ERPTB election, etc.), as ADS life was reduced from 40 years to 20.

- For taxpayers without an ERPTB election in place as of 2018, determine the impact of this change on the cost-benefit analysis of potentially making an ERPTB election in 2019 or subsequent tax years.

For the latest regulatory updates and more information on keeping your business running through disruption, visit our COVID-19 Resource Center.

April 02, 2020